Services

We help people pursue their financial goals

Financial Planning

Financial Planning Areas of Experience

- Asset Management

- Retirement Planning

- Social Security Planning

- Retirement Income Planning

- Distribution Planning

- Insurance Planning

- Estate Planning

Determine Your Current Finanical Situation

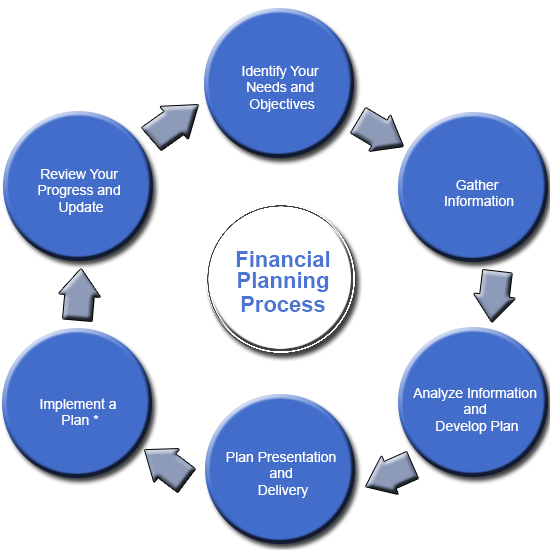

The very first step in the financial plan process is to look at your current financial situation.

Set Financial Goals

Setting financial goals is a great way to base a financial plan on. Your financial goals should be very clear and straightforward.

Customized Recommendations

Once you’ve set your financial goals and weighed down all the alternative plans, you come up with a final action plan. This action plan would be directed towards achieving your financial goals in order or priority.

Ongoing Collaborative Visits

Wealth management and financial planning is a continuous process. We will visit to review your goals, progress, and investment allocations regularly. You will have the option to visit in-person or virtually annually, semi-annually, or quarterly.

Determine Your Current Finanical Situation

The very first step in the financial plan process is to look at your current financial situation.

Set Financial Goals

Setting financial goals is a great way to base a financial plan on. Your financial goals should be very clear and straightforward.

Customized Recommendations

Once you’ve set your financial goals and weighed down all the alternative plans, you come up with a final action plan. This action plan would be directed towards achieving your financial goals in order or priority.

Ongoing Collaborative Visits

Wealth management and financial planning is a continuous process. We will visit to review your goals, progress, and investment allocations regularly. You will have the option to visit in-person or virtually annually, semi-annually, or quarterly.

Retirement and Social Security Planning

Areas of experience:

- Asset Management

- Retirement Planning

- Retirement Income Planning

- Tax Planning

- Insurance Planning

- Estate Planning

- Business Financial Planning

- Social Security Planning

Wealth and Investment Management

Wealth doesn’t have to be complicated. You receive transparency of fees, proactive service, and accountability you need to pursue your financial goals. We work closely with your bankers, CPA, attorney, and other advisors.

Investment Services include the following but are not limited to:

- College Savings

- Risk Management

- Managed Accounts

- Annuities

- Stocks and Bonds

- Mutual Funds

- IRA/Rollover Services

- CDs

- Structured Notes

- Municipal Bonds

By virtue of using the Strategic Asset Management and Model Wealth Portfolios, we can work under a fee-based model. Fee-based asset management allows us to share a common goal with you: to grow the value of your assets. A holistic approach to investing, fee-based asset management ties our compensation directly to the performance of your account. Instead of commissions, we earn an annual fee based on the market value of the account. This allows us to concentrate on what matters most building an investment portfolio that seeks to address your specific needs.

Potential Benefits of Advisory Accounts

- Full-time professional supervision

- Transparency into account activity

- Potential tax-efficient investing

- Custom-tailored portfolios

- Tactical asset allocation

- Diversification among managers, asset classes, and market sectors

- Comprehensive analysis and reporting

- Active, ongoing portfolio to review investment strategy to make sure it continues to stay aligned with your goals

- Tax-loss harvesting

- Simple one fee: no trading fees or ongoing commissions

- Year-end statements including annual advisory account

FAQs

Small Business Planning

Save time and energy. As a small business owner, you wear a lot of hats and are constantly switching between them. Let us help you!

- Wolf Wealth Management offers a variety of retirement plan options, including IRAs, business plans such as 401(k), SEP and SIMPLE IRAs, as well as 403(b) plans for nonprofit organizations. Different plans have a variety of features, benefits, and tax advantages to help you save for your retirement.

- Comprehensive and ongoing fiduciary guidance.

- Work closely with local third-party administrator to help with plan design.

- Help educate employees with in person visits. Customized plans to help increase employee outcomes.

- Collaboration is critical! We work closely with CPA, bankers, and attorneys to make sure everyone is on the same page.

- Exit Strategies: Help prepare you, your family, and your business for a successful exit.